Insurance

Enabling carriers and reinsurers to seamlessly integrate geospatial data into their decision making

Strategic Partners

We collaborate with leaders in geospatial data to build the most robust and dynamic geospatial marketplace

Case Study

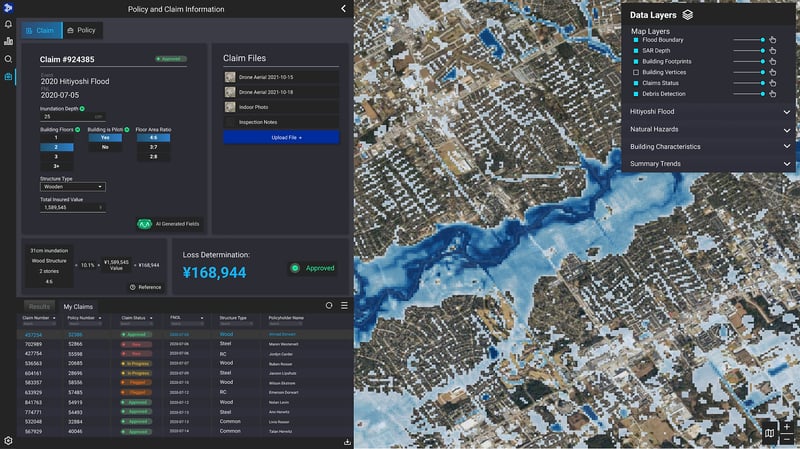

Building a Claims Application with MS&AD

In 2021, MS&AD approached our insurance department to help them overhaul their claims processes through digital transformation, which would enable them to more efficiently receive and process claims. Prior to this partnership, MS&AD’s claims databases were siloed and inaccessible, and customers had to submit claims information manually, which led to slow and inefficient claims processing and payout.

The MS&AD Claims team leveraged our data marketplace to select the data (from satellite imagery, drones, and IoT) that provided insight on areas of interest post large-scale catastrophic events.

In addition to this data fusion, we built proprietary AI/ML models to automate damage assessment, and overlaid it with the existing data; this functionality provides claims with the comprehensive knowledge of post-cat damage. Finally, we piped all data and analytics models into a customized, single software environment for claims; claims analysts are now able to easily access the insights from spatial data with little to no training. As a result, MS&AD can quickly estimate claims amounts, approve loss amounts in minutes, and operate more efficiently.

Challenges

Barrier to Entry

There is an overwhelming amount of geospatial data and it requires unique expertise to be usable.

Legacy Systems

Data is advancing faster than insurance carriers can consume it due to a reliance on legacy systems.

Long Wait Times

Insurance carriers experience long wait times to access post-catastrophe data.

Multiple Contracts

Insurance carriers hold many contracts with many providers for underwriting and claims data.

Coverage Gaps

Insurance carriers experience coverage gaps and lack of granularity for underwriting data.

Poor Location Accuracy

Carriers’ property location data is often inaccurate making geospatial analysis difficult.

Solutions

Market Knowledge

We work with many providers and leverage state-of-the-art machine learning to recommend different solutions based on a carrier's unique needs.

Modern Technology for New Geospatial Data

Our tech stack enables us to work with a wide variety of modern data sources and formats.

Faster Data Access

We provide insurance carriers with empirical post-catastrophe data within 24-48 hours after data collection.

One Contract

We handle the data acquisition process to flow data from multiple sources, so carriers only need to handle a single contract—with us.

Full Coverage for Underwriting Data

We address data gaps and provide insurance carriers with the necessary data to make more informed underwriting and claims decisions.

Improved Location Accuracy

Geolocation services increase the location accuracy of a carrier's assets by at least 50%.

Legacy System Integration

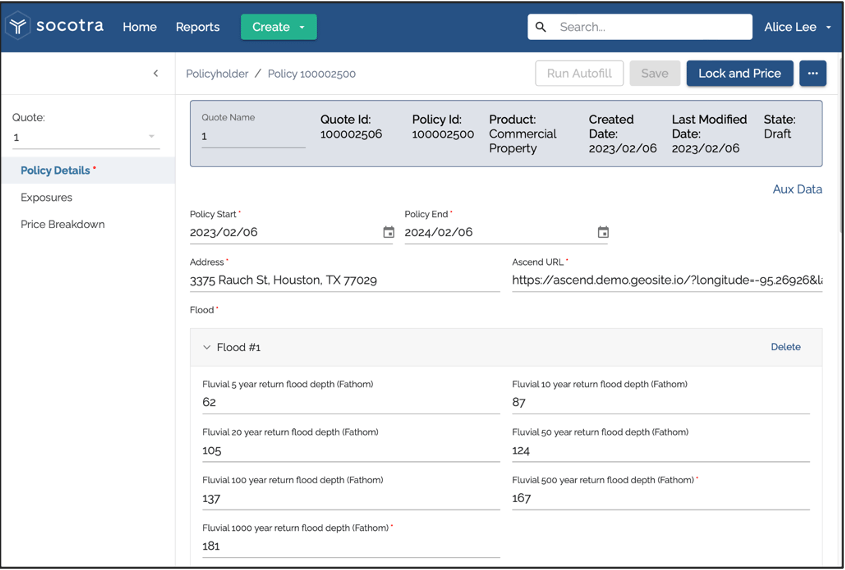

In 2022 we announced our partnership with Socotra.

With this integration Underwriters and claims agents have automatic access to the best flood models, fire models, property analytics, and geocoding in the world directly within their day to day underwriting and claims workflow.